Why Now Is the Time to Buy in Southwest Florida — and Why Waiting for Rates to Drop Could Cost You

If you’re sitting on the sidelines waiting for interest rates to come down before buying, you may be underestimating one of the biggest risks in today’s market: home prices going up while you wait. In the Southwest Florida region (Cape Coral / Fort Myers), the current conditions offer a sweet spot — and what you lose by waiting may far outweigh the short-term gains from a slightly lower rate.

1. The “Everything’s on Sale” Moment

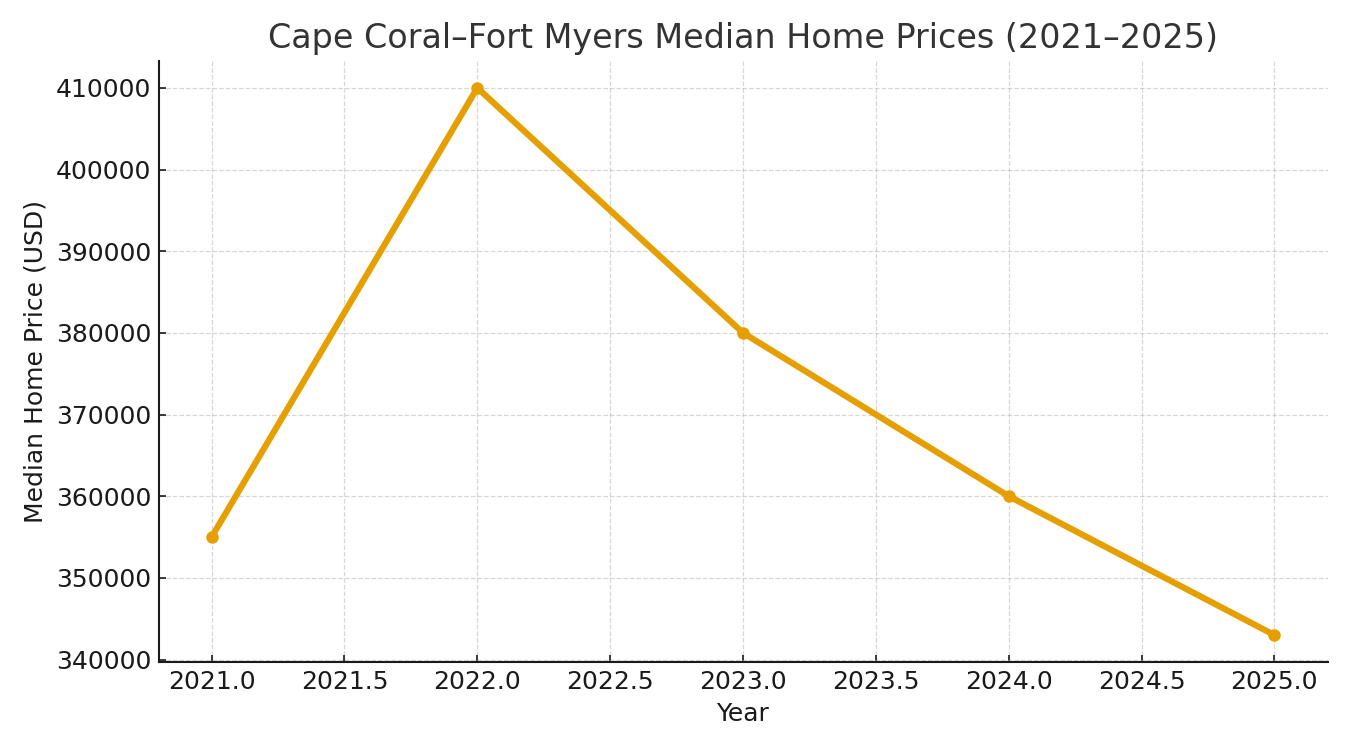

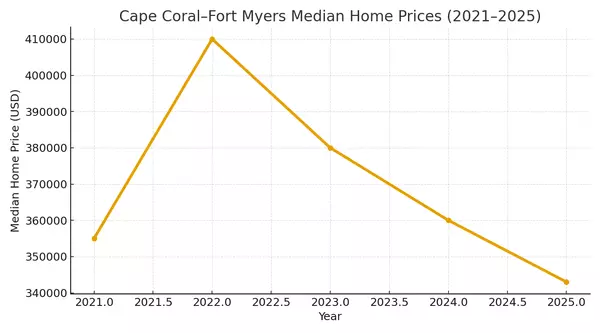

In the Cape Coral-Fort Myers market we’re seeing something interesting: home prices have pulled back somewhat from their pandemic peaks, giving buyers more negotiating power and choice.

-

According to Zillow data, the average home value in Cape Coral-Fort Myers is around $343,471, down about 10.4% over the past year. Zillow

-

Realtor.com numbers show median listing price in the metro was down about -6.7% year-over-year in May 2025. Realtor

-

More local reporting shows that while prices are down, they are stable compared to 2021 levels: e.g., the June 2025 median sale price in Cape Coral was ~$361,975 vs ~$355,000 in October 2021. rpcra.org+1

What this means: you have the opportunity to buy when there is less upward pressure from buyers rushing in, and with greater negotiating leverage. That’s the “on sale” moment.

2. Why Waiting for Interest Rates to Drop Is Risky

It’s tempting to think: “Let’s wait until mortgage rates go down, then I’ll pull the trigger.” But here’s what you need to consider:

-

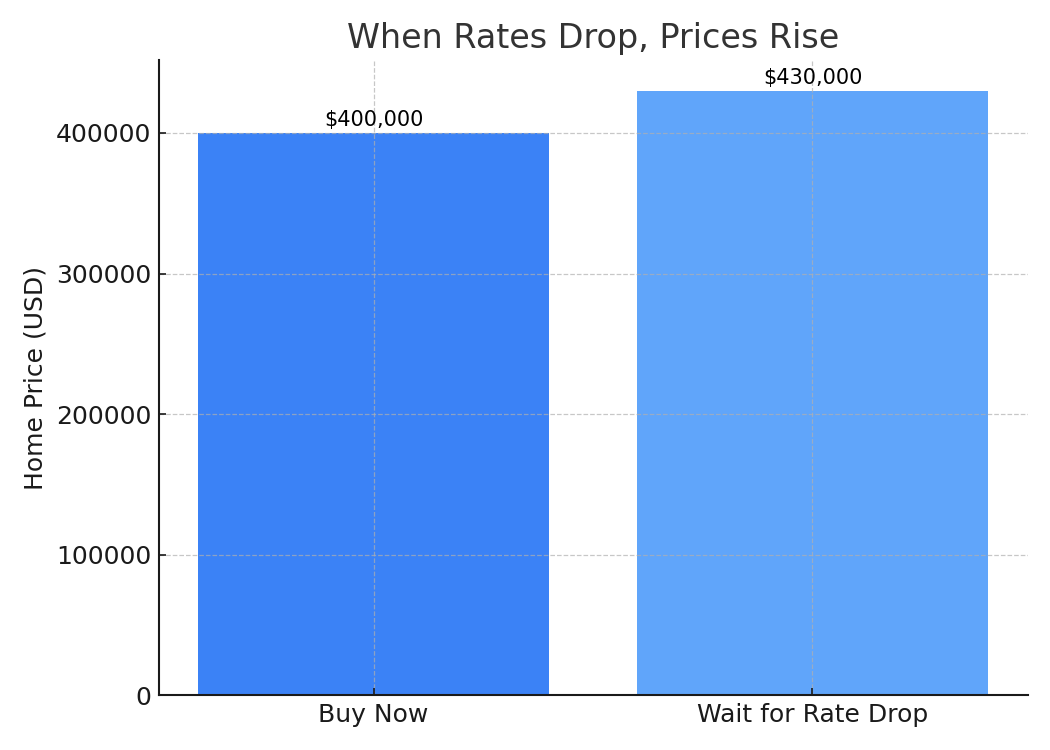

Research confirms the relationship: when interest rates drop, housing demand tends to increase — and home prices frequently rise as a result. Quicken Loans+1

-

A Federal Reserve-Bank of Dallas analysis found that a 1-percentage-point increase in short-term interest rates lowers house prices by ~7.5% over two years — implying the reverse: a drop in rates would likely push prices upward. Federal Reserve Bank of Dallas

-

The homeowner-cost equation: you can refinance a mortgage later if rates go down, but you cannot go back in time and avoid paying the higher price you pay for the home today if prices climb. In other words: you lock in your purchase price today; you can only hope for a lower rate later.

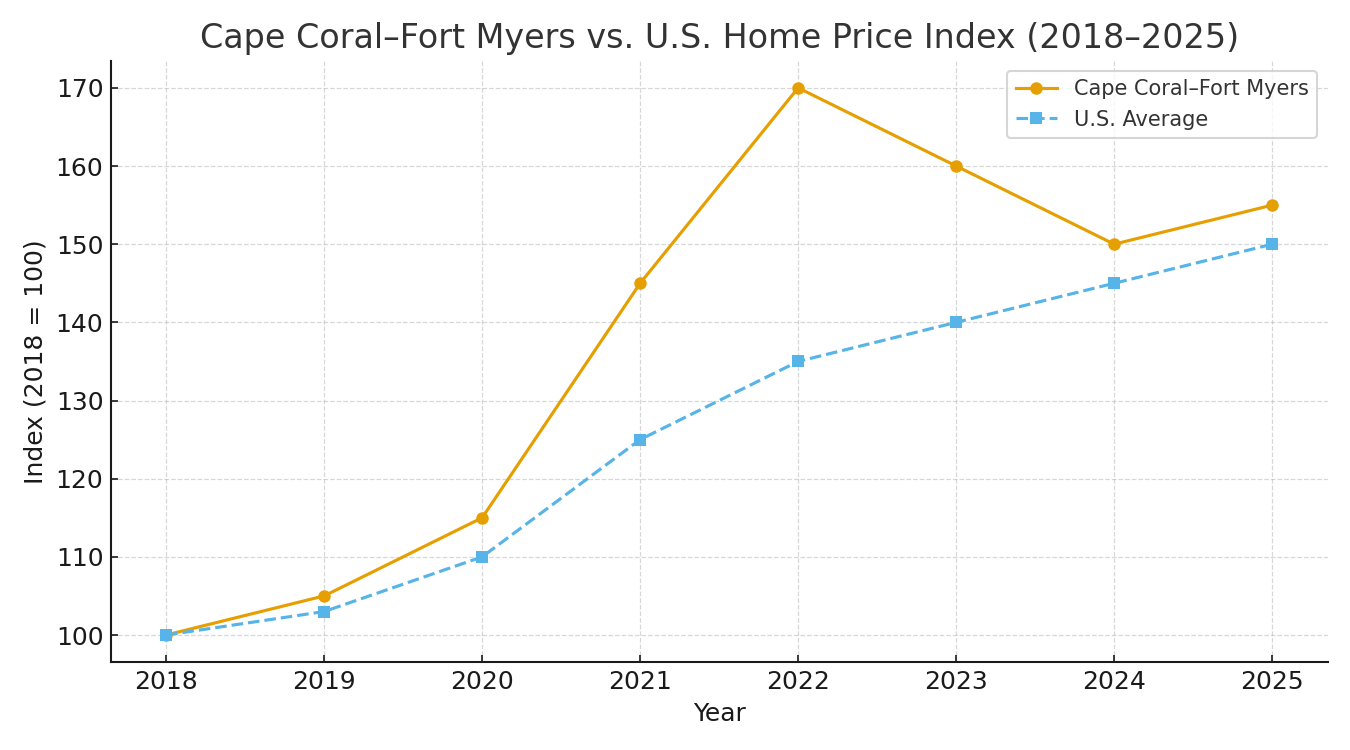

3. Why Southwest Florida Is Typically First to Drop — and First to Rebound

The Cape Coral-Fort Myers market has some traits that make it more volatile — both on the way down and on the way back up:

-

It led the surge during the pandemic boom. And as one report says, it also led the pull-back: “home prices in Cape Coral-Fort Myers have fallen about 11% over the two years through May” according to the Wall Street Journal. The Wall Street Journal

-

Because of that, when interest rates ease, this region often recovers faster. The fundamentals remain strong: Sunshine, canals, Gulf-access, boating, and in-migration from other states. The earlier pull‐back gives savvy buyers opportunity, but also gives evidence that waiting could mean missing the jump back up.

4. Buyer Strategy: Lock In the Price, Flex the Rate Later

Here’s a concrete strategy you can discuss with your clients:

-

Step 1: Buy now at today’s price while negotiation leverage exists. Even if mortgage rates are higher (they are currently elevated), you’re securing the underlying asset at a “discounted” level relative to where the market likely heads.

-

Step 2: Plan to refinance when rates drop. The interest rate side is movable, and you’ll have time to refinance when the conditions are right.

-

Step 3: Enjoy the lifestyle and long-term equity. If prices go up — as they likely will if interest rates come down — you benefit from that appreciation while you locked in early.

5. Data-Backed Case:

-

Rates are elevated. According to U.S. Bank analysis: “Today’s mortgage rates are close to double rates of 2021.” U.S. Bank

-

Home price outlook nationally: J.P. Morgan Research expects U.S. house prices to rise ~3% overall in 2025, even in a higher-for-longer interest-rate backdrop. JPMorgan Chase

-

Locally: Cape Coral median listing prices are down ~7% year-over-year — meaning you’re buying into a market where values are off a high watermark, not necessarily still falling. FRED+1

6. The “What If Rates Drop?” Scenario

What happens when interest rates eventually come down? Likely three things:

-

More buyers enter the market because mortgages become more affordable.

-

Demand increases in markets with constrained supply — like Southwest Florida — pushing up prices.

-

Sellers who’ve been holding off may enter, but they’re also reacting to expectations of higher prices, so pricing may reflect wind-up rather than bargains.

Essentially: when rates drop, you’ll likely face higher prices and more competition. And while you can still refinance, you’ll not get to go back and purchase at yesterday’s lower price.

7. Final Thoughts for Your Clients

-

Yes — rates are higher than the “good old days” of 3-4%. But that’s been baked into the market for some time.

-

The real opportunity right now: home prices in this market have pulled back, giving buyers more negotiating room.

-

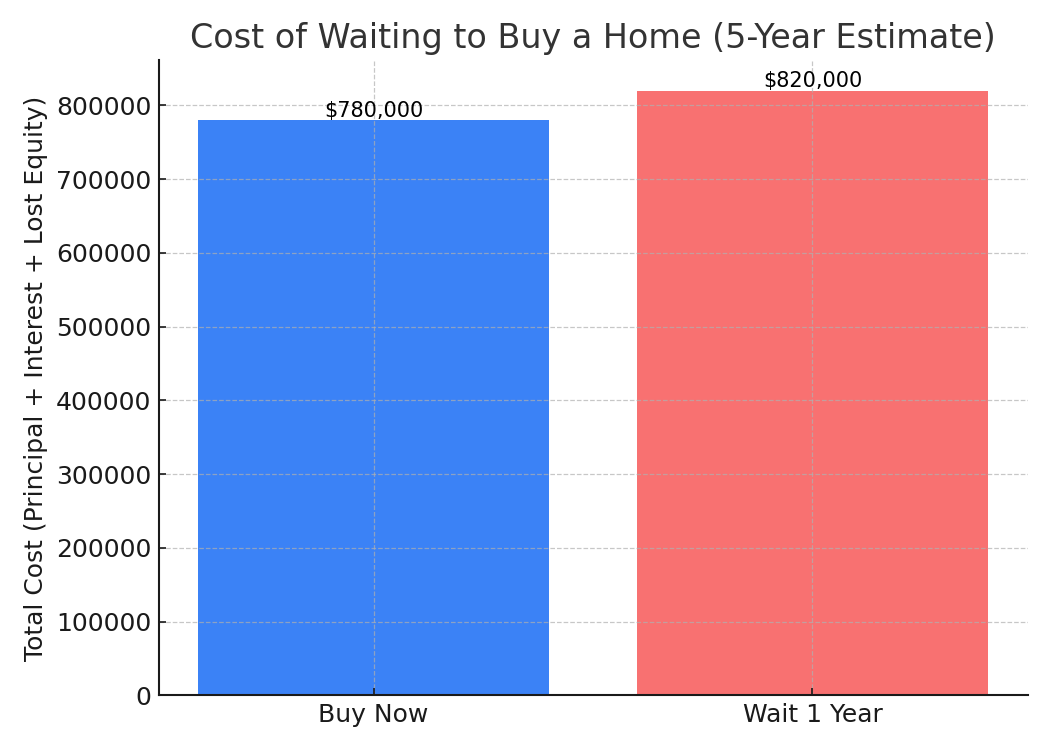

Waiting for a rate drop may save you a little on monthly payment now, but it could cost you thousands or tens of thousands in lost equity if prices rise later.

-

My role is to help you evaluate the overall cost-of-waiting: monthly payment + purchase price + timing of refinance + local market dynamics.

-

If your goal is long-term homeownership in Southwest Florida — enjoy the lifestyle, build equity, and leverage mobility — the best time to buy is now, not later.

If you'd like to discuss current opportunities in the Cape Coral or Fort Myers area, review rate/price scenarios, or explore how this strategy could work for you — I’d love to help.

Categories

Recent Posts

Epique Realty

Phone