What Every First-Time Homebuyer Should Know About Buying in Southwest Florida

Buying Your First Home? Let’s Make It Easier.

Buying your first home is exciting — but it can also be overwhelming, especially here in Southwest Florida, where every neighborhood, canal, and community has its own unique perks (and pitfalls).

Whether you’re buying in Cape Coral, Fort Myers, Lehigh Acres, or anywhere in between, here’s what you need to know before you start house hunting.

💰 1. Understand the True Cost of Homeownership

In Florida, your monthly mortgage payment is only part of the story. You’ll also need to account for:

-

Homeowners insurance (especially wind and flood coverage)

-

Property taxes, which vary by city and location

-

HOA or CDD fees in certain gated or master-planned communities

-

Utility costs (many Cape Coral homes rely on well and septic systems)

💡 Tip: Ask your lender for a full monthly estimate including taxes, insurance, and HOA fees so you can budget accurately.

📍 2. Location Matters — But for Different Reasons Here

In Southwest Florida, location isn’t just about commute time — it’s about lifestyle.

🌴 Want boating access? Look for Gulf-access canal homes in Cape Coral.

🏫 Need schools nearby? Fort Myers and Estero have excellent family-friendly options.

💼 Working remotely? North Cape Coral and Gateway offer new construction with easy access to I-75.

Think about how you live day-to-day — not just where the map looks good.

🏠 3. Don’t Skip the Home Inspection

Even newer homes can hide issues, especially in Florida’s heat and humidity.

Make sure your inspection covers:

-

Roof age and condition

-

AC performance and age

-

Electrical panel type (certain brands can cause insurance issues)

-

Plumbing materials (polybutylene can be a red flag)

An experienced local inspector will know what to look for — and can save you from major surprises later.

🏦 4. Choose the Right Loan Program

As a first-time buyer, you may qualify for programs that make buying easier, such as:

-

FHA Loans – Low down payment, flexible credit

-

VA Loans – No down payment for eligible veterans

-

USDA Loans – Great for more rural areas like north Cape Coral or Lehigh Acres

-

Florida Hometown Heroes Program – Down payment assistance for qualified buyers

Work with a local lender who understands Florida-specific requirements like wind mitigation credits and flood insurance estimates — it’ll make the process smoother and often more affordable.

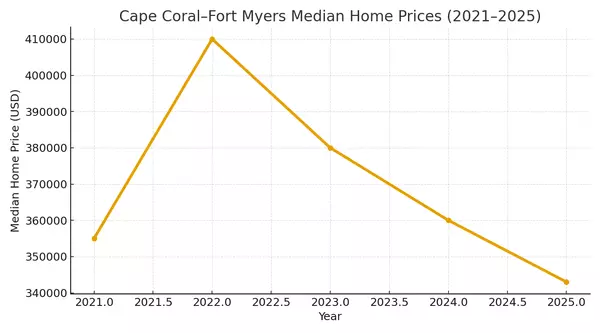

🧾 5. Don’t Wait for the “Perfect Time”

If you’re waiting for mortgage rates to drop, you could end up paying more in the long run.

When rates go down, competition and prices go up.

In 2025, the Southwest Florida market has already stabilized, meaning buyers can negotiate, take their time, and often pay less than they would in a bidding war.

Remember: you can refinance your rate later — but you can’t go back and lower the price you paid for the home.

🧠 6. Work with a Local Realtor Who Knows the Market

Southwest Florida is unlike anywhere else in the country — from flood zones to insurance regulations to neighborhood quirks.

Working with a full-time local Realtor who lives and works here (like me) can help you:

✅ Avoid costly mistakes

✅ Find hidden gem neighborhoods

✅ Negotiate with local insight and leverage

✅ Connect with trusted local inspectors and lenders

🏁 The Bottom Line

Buying your first home in Southwest Florida doesn’t have to be stressful — you just need the right information and the right team.

Understand your costs, choose the right area, and don’t let fear or rates keep you from building equity and stability now.

Whether you’re ready to start house hunting or just want a game plan, I’m here to help guide you step-by-step through your first home purchase in Cape Coral, Fort Myers, and beyond.

Categories

Recent Posts

Epique Realty

Phone