Understanding Property Taxes in Southwest Florida: What Buyers Should Know

The Hidden Cost of Homeownership

When buying a home in Southwest Florida, most people focus on the purchase price and insurance — but property taxes can be just as important. Understanding how they work can help you make smarter financial decisions and avoid surprises down the road.

How Florida Property Taxes Work

Property taxes in Florida are based on the assessed value of your home, which is determined by the county property appraiser. This value is multiplied by the local millage rate (the tax rate per $1,000 of value) to calculate your annual tax bill.

Each county — Lee, Collier, Charlotte, and others — has different rates depending on city limits, schools, fire districts, and other services.

💡 Example:

If your home’s assessed value is $400,000 and the millage rate is 15 mills (or $15 per $1,000), your annual property tax would be around $6,000.

Save Thousands with Florida’s Homestead Exemption

Florida homeowners who make their property their primary residence can apply for the Homestead Exemption, which can reduce the taxable value by up to $50,000.

Even better — it caps how much your assessed value can increase each year to no more than 3% (or the CPI, whichever is lower).

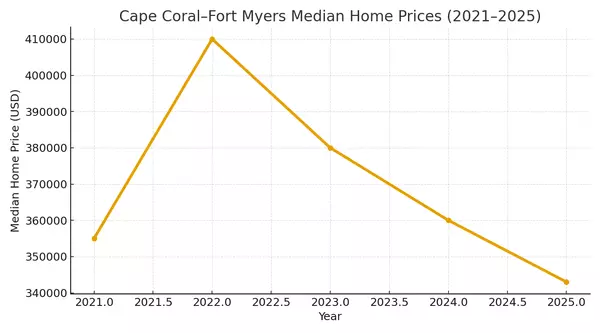

This protection, called Save Our Homes, helps keep your taxes more predictable over time — especially valuable in a rising market like Southwest Florida.

When You Buy a Home, Your Taxes Will Reset

A common mistake buyers make is assuming the seller’s current tax bill will be the same after closing.

In reality, once the home sells, the property is reassessed at market value, which often means a higher tax bill for the new owner.

Before you buy, always ask your agent (that’s me!) for an estimated property tax projection based on today’s value, not last year’s numbers.

Tax Benefits of Florida Homeownership

✅ No state income tax — one of Florida’s biggest draws.

✅ Portability — if you sell your primary home and buy another in Florida, you can transfer some of your Homestead savings to the new property.

✅ Deductions — in some cases, you can deduct property taxes on your federal tax return (consult your tax professional).

Final Thoughts

Property taxes may not be the most exciting part of homeownership, but understanding them can save you thousands. Whether you’re buying your first home or your next investment property, knowing how the system works in Southwest Florida ensures there are no surprises after closing.

I help buyers review estimated taxes and exemptions before making an offer — so you can move forward with confidence.

Categories

Recent Posts

Epique Realty

Phone